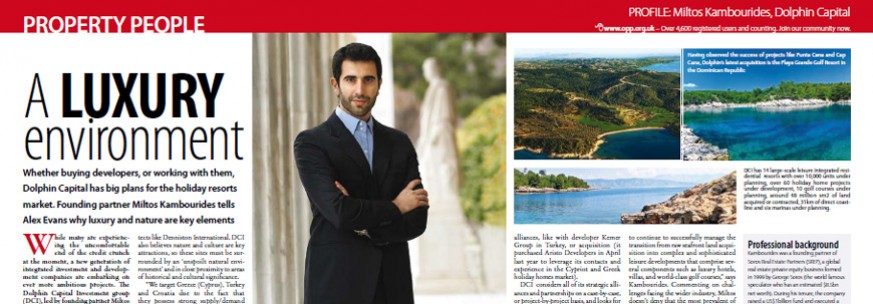

Whether buying developers, or working with them, Dolphin Capital has big plans for the holiday resorts market. Founding partner Miltos Kambourides tells Alex Evans why luxury and nature are key elements.

While many are experiencing the uncomfortable end of the credit crunch at the moment, a new generation of integrated investment and development companies are embarking on ever more ambitious projects. The Dolphin Capital Investment group (DCI), led by founding partner Miltos Kambourides, is one such company. Focusing on the residential resort sector in south-east Europe, DCI has been busy acquiring plots, projects and property companies.

Since the company’s launch in 2005, it has raised €859 million of equity funds and is currently the biggest real estate investment company on the London Stock Exchange (AIM). Explaining that profile and the freedom to expand have been the biggest benefits of the decision to list, Kambourides says: “We decided to go on AIM because of the capital-raising flexibility it provides, the visibility in the market and the comparatively lighter regulatory requirements that suit fast-growing companies.”

Targeting affluent holiday/retirement home buyers from northern Europe, Russia and the Middle East, DCI has very specific criteria for its projects and looks for coastal land sites over 100 hectares in size ‘with visible development potential’. Master-planned as ‘sophisticated residential resorts integrated with leisure components’, they are branded and managed by ‘world renowned luxury operators’ like Aman Resorts or designed by leading architects like Denniston International. DCI also believes nature and culture are key attractions, so these sites must be surrounded by an ‘unspoilt natural environment’ and in close proximity to areas of historical and cultural significance.

“We target Greece (Cyprus), Turkey and Croatia due to the fact that they possess strong supply/demand fundamentals, limited competition and high barriers to entry,” continues Kambourides. “Furthermore, all countries where we hold investments share the common characteristics of unspoilt landscapes, natural settings, a range of sightseeing and other leisure activities, and some of the world’s most attractive coastlines. We strongly believe that the eastern Mediterranean and certain areas of the Caribbean and Central America will offer buyers the best combination of capital growth and lifestyle over the next two years (and beyond) because of the very limited supply.”

Partner profile

To establish itself in these markets, DCI has partnered with high profile architects, golf course designers and hotel operators to not only create sophisticated projects but capitalise on the profile of these global brands. It has also achieved this through strategic alliances, like with developer Kemer Group in Turkey, or acquisition (it purchased Aristo Developers in April last year to leverage its contacts and experience in the Cypriot and Greek holiday homes market).

DCI considers all of its strategic alliances and partnerships on a case-by-case, or project-by-project basis, and looks for ‘likeminded organizations committed to producing a premium quality product’. “Above all else,” says Kambourides, “we only enter into arrangements which will result in value creation for shareholders. As we enter the construction phase of our projects we work with leading local financial institutions as well as prominent global financing firms for the execution of financing arrangements.”

The ability to source finance is a major component in any strategic alliance, benefiting everyone involved at all levels. Kambourides adds that his team’s expertise in real estate investment, combined with “a valuable international network of industry professionals”, is a key part of its proposition for its developer partners.

Adapt to succeed

A clear strategy, based on knowledge of the target buyer, the kind of product they want, and identifying the right partners to deliver it, must adapt to changes in the market, economy and industry. For a company delivering a specific kind of resort product, planning is an obstacle. “The biggest challenge is ensuring that the permitting process remains on track to continue to successfully manage the transition from raw seafront land acquisition into complex and sophisticated leisure developments that comprise several components such as luxury hotels, villas, and world-class golf courses,” says Kambourides. Commenting on challenges facing the wider industry, Miltos doesn’t deny that the most prevalent of all is the credit crisis which, he feels, has negatively impacted both developers and home buyers in mature markets. That said, DCI believes it is in a stronger position because of its “significant capital resources” and policy of constantly reviewing investments and acquisitions. But what does it recommend for its peers and potential partners?

“The international holiday homes industry would be well served to focus on the upscale and environmentally sensitive segments,” he suggests. “We at Dolphin focus on the development of luxury resort complexes which have the characteristics of being low density and environmentally friendly, which provide a luxury resort experience and appeals to the extremely wealthy segment. This approach has only recently emerged and has largely been very successful. One only needs to look at the various high-end, luxury developments to see evidence of this.”

Like many of its competitors, in and outside Europe, targeting the world’s wealthy buyers with the right combination of location, lifestyle, growth potential and brand association is seen as key to future success.

Professional background

Kambourides was a founding partner of Soros Real Estate Partners (SREP), a global real estate private equity business formed in 1999 by George Soros (the world famous speculator who has an estimated $8.5bn net worth). During his tenure, the company raised a US$1billion fund and executed a number of complex real estate transactions in Western Europe and Japan. While at SREP, he was primarily responsible for investments relating to property outsourcing in the UK and for the SREP investment strategy in southeast Europe. He was the deal leader and a founder of Mapeley Ltd, which went on to become the second largest real estate outsourcing company in the UK after winning two major 20-year multi-billion- GBP contracts: one with the Inland Revenue and Custom & Excise Departments of the UK and one with the Abbey National bank. Before joining Soros, he spent two years at Goldman Sachs working on real estate private equity transactions in the UK, France and Spain. In 1998, he received a Goldman Sachs Global Innovation award for his work at Trillium, the largest real estate outsourcing company in the UK. Kambourides founded the Dolphin Capital Investment group in 2004 and Dolphin Capital Investors (www.dolphinci.com) was launched with €5million of seed capital in the summer of 2005. Since that time, DCI has raised €859 million of equity funds and is currently the largest real estate investment company on AIM.